File Your Taxes for Free!

Both Arkansas and the IRS have programs that allow individuals who meet certain requirements to file their taxes for free! Follow the links below to find online providers that will figure and file your taxes for free (assuming you meet their qualifications). Most companies will provide step-by-step instructions and easy to fill out forms. If you choose to have your tax refund electronically deposited into you bank account, you may receive your refund in as little as 8 - 10 days.

You can begin by either clicking on the links below or click here to see a list of providers that will prepare and efile both your Arkansas and federal taxes for free. You MUST either follow the links in this guide or on the official free file pages. Going directly to the company website may not take you to their free services and you could be charged a fee.

Arkansas is member of the Free File Alliance, a group of software providers working with the State of Arkansas and the IRS to donate free tax preparation for taxpayers. The software providers listed on the Arkansas Office of Income Tax Administration's homepage will file BOTH your state and federal taxes for free, assuming you meet their requirements. Most people who make $60,000 or less will qualify.

|

Free File is the fast, easy and free way to prepare and e-file your federal taxes online. Most people who make $79,000 or less a year qualify for Free File. If you make over $79,000, you can still use the free forms to efile your taxes yourself. |

Companies that will file your state and federal for free:

The following companies / website will figure and efile your Arkansas and federal taxes for free assuming you meet their qualifications. The following links will take you directly to the file free pages. Please note that if you go directly to the company site, you may not be able to find the free file section.

Click on any of the following links for more information about the company, their services and their qualifications. Some companies may limit which forms they will file (for the most part, all major forms should be covered).

TaxAct Free File

IRS Free File Program Delivered by TaxAct®

- Adjusted Gross Income of $79,000 or less, and

- Age between 20 - 58, or

- Active Military with Adjusted Gross Income of $79,000 or less

Online Taxes at OLT.com

https://www.olt.com/main/oltstateff/default.php

Online Taxes at OLT.com would like to offer free federal and free state online tax preparation and e-filing if your Federal Adjusted Gross Income is $45,000 or less regardless of age.

Activity Duty Military with an adjusted gross income of $79,000 or less will also qualify.

The OLT Free File website must be accessed through the link above. This offer is also valid from the IRS Free File offer.

1040Now - Free, Easy and Accurate

Free federal and Arkansas tax preparation & e-file for all who live in Arkansas with an Adjusted Gross Income (AGI) of $32,000 or less. This offer is limited to three (3) free tax returns per computer.

Our Free File URL: http://www.1040now.net/freefilear.htm

FreeTaxUSA

FreeTaxUSA will be offering free electronic preparation and filing services for both Federal and Arkansas tax returns to eligible Arkansas taxpayers. For a taxpayer to be eligible to use our free services, they will need to meet the following requirements:

- Adjusted Gross Income of $45,000 or less --OR--

- Served active-duty military in 2023 with Adjusted Gross Income of $79,000 or less.

Visit website at: https://www.freetaxusa.com/freefile2023

TaxSlayer

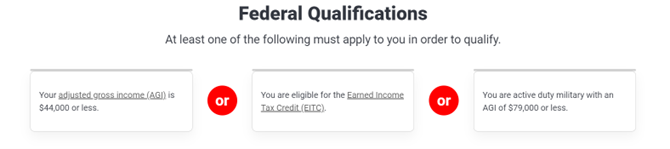

- AGI of $44,000 or less

- or qualify for EITC

- or Active duty military with AGI of $79,000 or less.

https://www.taxslayer.com/americanpledge/default.aspx?source=TSUSATY2023

1040.COM

IRS Free File Program Delivered by 1040.com®

- Adjusted Gross Income between $17,000 and $79,000 and

- Any Age or

- Active Military with Adjusted Gross Income of $79,000 or less

URL: https://www.1040.com/IRSFreeFile